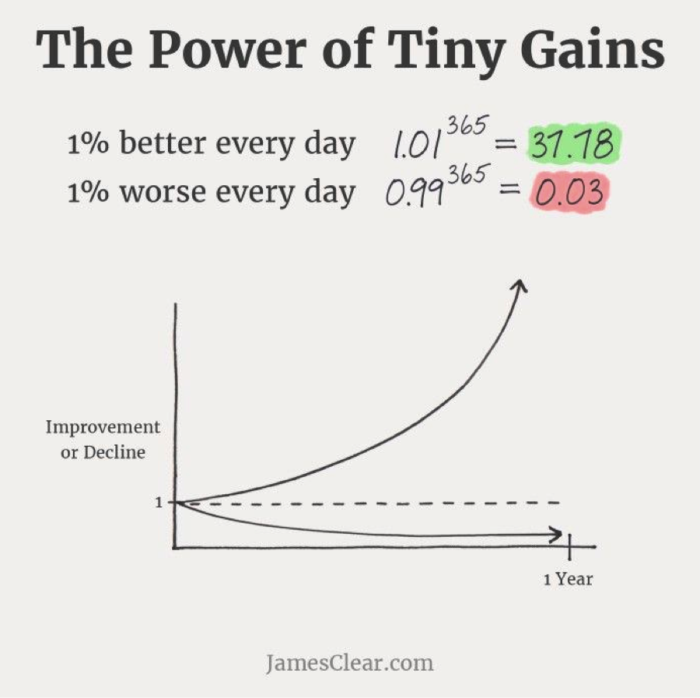

The following chart by the author of Atomic Habits is incredibly powerful to contemplate. It displays what relatively small actions (1%) applied daily for one-year results in, in both a positive or negative direction.

As you can see, 1% applied positively yields a significantly higher result than being 1% worse every day for the same time period. While many people are familiar with this compounding concept when applied to financial graphs, typically over the course of several decades, it’s less common to consider this in the realm of personal or entrepreneurial growth.

To state this differently, applying 1% positively daily for 365 days results in a 199.7% difference than applying it negatively for the same duration.

When was the last time you received a 200% raise? Or increased your prices by that much? Purely from a growth standpoint, this is also incredibly more powerful than anything rate of return you’ll get from an index fund or ETF.

Given “Mathematics is the language with which God has written the universe”, to quote Galileo Galilei, let’s break down the magic behind the scenes.

James Clear’s chart is based on the equation y = a(1 + r)x where:

- y = value of the variable after x periods (future compounded value)

- a = initial value of the variable

- r = compound growth rate

- x = number of periods

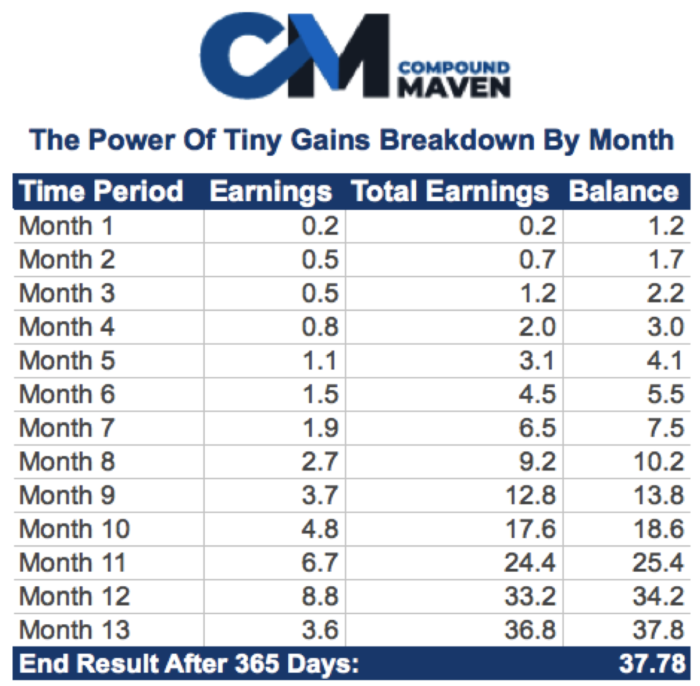

To visualize this more granularly, this equation looks like the following when broken out monthly:

You’ll see earnings start off pretty slowly, but once you reach month nine, your monthly momentum really starts to jump. Between month nine and 10 the gains you realize exceed four for the first time, followed by 6.7 in month 11.

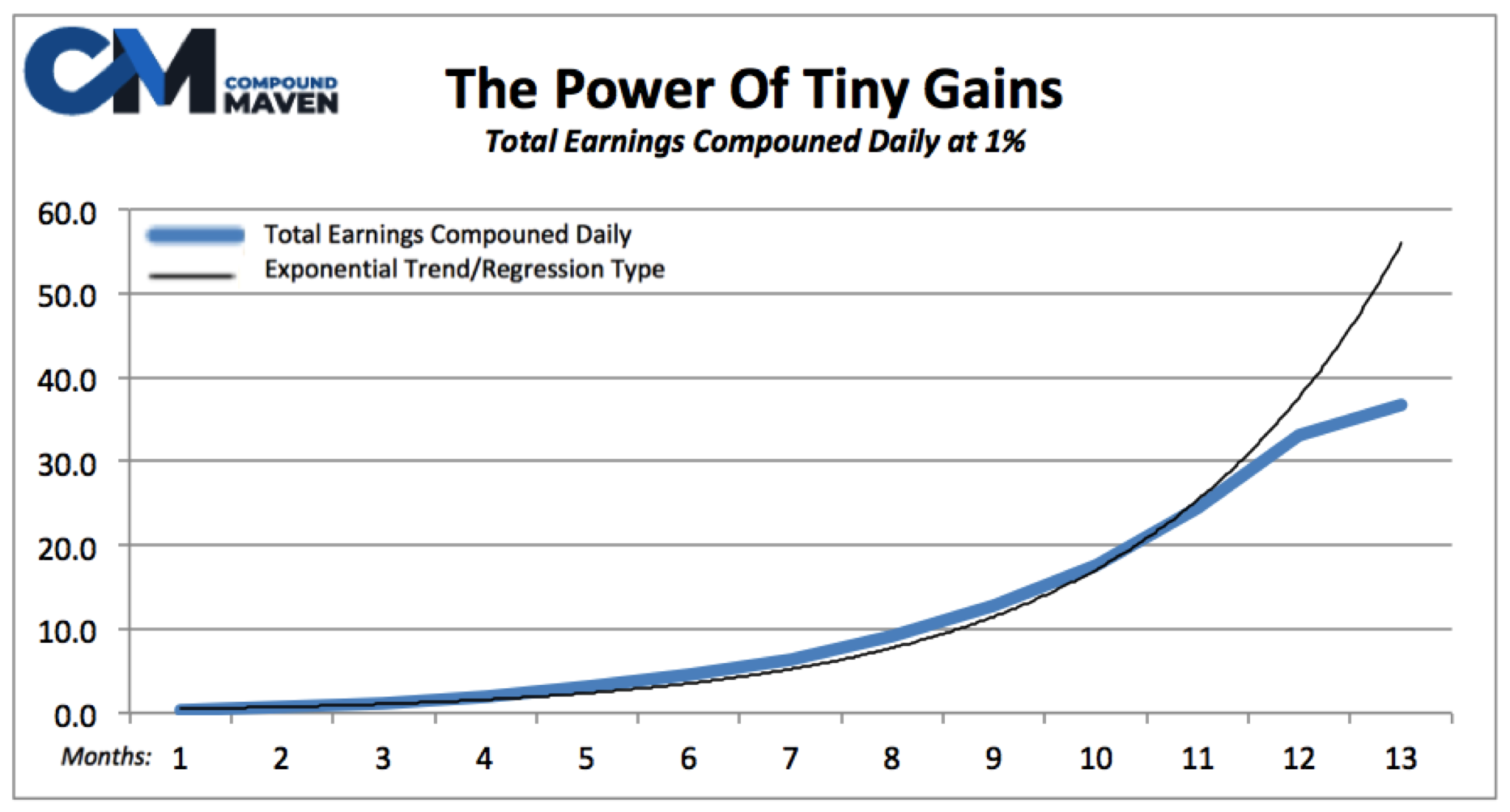

This can be charted via a simple exponential trend/regression type in Excel. The black line in the following chart shows the curve in a more detailed way, which is worth printing and placing in a prominent corner of your office or workspace should you experiment with this in the real world.

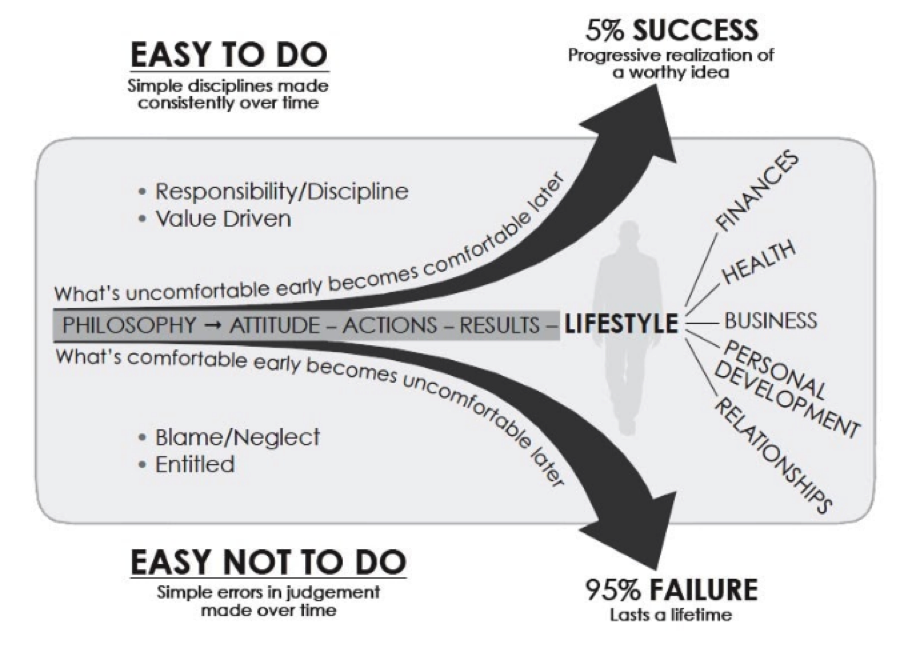

In appreciating this in the context of personal or business growth, consider Jeff Olson’s visualization from his book The Slight Edge (Turning Simple Disciplines into Massive Success and Happiness):

This powerful perspective leverages the underlying behavioral orientation that’s required, listed as “responsibility/discipline” and “value driven”. This obviously needs to be rooted in an optimistic outlook where you believe your actions or decisions truly matter. Otherwise, more damaging connotations can trickle in (oftentimes blame/neglect or entitlement).

Not ironically, if you start reading the opinions of highly successful businesspeople or those who have achieved high levels of financial prosperity, it’s almost impossible to identify people with highly entitled or perpetually negative frameworks; of course there are some rare exceptions to this, but in my reviews that doesn’t tend to happen with individuals who are “self-made”.

Take the following for example, from Dan Kennedy’s No B.S. Marketing To the Affluent: No Holds Barred Kick Butt Take No Prisoners Guide to Getting Really Rich:

What The Wealthy And Successful Believe That The Poor And Unsuccessful Do Not

“If you roam the libraries and bookshelves in any ten affluent or ultra-affluent individuals’ homes and offices, you will find at least seven well stocked with what I call the literate of the rich. Books like Think and Grow Rich, The Power of Positive Thinking, The Magic of Thinking Big, and other classic perennial bestsellers of similar theme. If you visit the homes of any ten poor people, you will likely find none of these books in any of the homes. It is not coincidence. It is causative. The possession of such books reveals a very particular and specific mindset on the part of the affluent—that there is a profound and direct link between their thoughts, attitudes, and beliefs and their prosperity.

Consequently, the affluent of this belief are conscious, even forced, optimists. They deliberately resist their own pessimism or pessimism delivered to them by others. The poor, on the other hand, are extremely pessimistic and welcome delivered pessimism as proof that their lack of success is rooted in circumstances beyond their control. The rich explain the poor as “poor of mind, poor in purse.” The next logical extension of this is that the rich tend away from skepticism, the poor tend to it. Pessimism and skepticism are close cousins. Because the rich strive not to permit themselves to be pessimistic, they automatically tend not to be skeptical.”

I’ve been financially poor in my life, so some of Kennedy’s words sting a bit. I also had to think through posting this numerous times, in part as I think it can come across as harsh. That said, speaking from professional experience, the times I’ve rallied to leverage personal accountability and positivity, even in extremely difficult times, I’ve looked in the rear view mirror with more success than I would have otherwise faced sitting on the sidelines or looking for someone else to blame.

And thus, the power of tiny gains can be a massively beneficial framework to consider. If you were to leverage it in 2021 or beyond, perhaps you too will find the following by Ramit Sethi, author of the top-selling financial book I Will Teach You To Be Rich to be helpful:

“When I think about the most successful people — CEOs, entrepreneurs, busy parents — one thing they all have in common is that they are positive, even when things aren’t going their way. It isn’t always easy to be optimistic.

There are systemic forces and outside circumstances that influence every part of our society and our everyday life. I believe in acknowledging our privilege and working towards a more just society. But I also believe in personal responsibility and possibility. Positivity is a choice.”

– Ramit Sethi November 2020