The first post published on this website was titled “We Still Don’t Appreciate The Internet”. It was written during a multi-leg journey across the north and southwest in 2020 and in the process of researching consumer behavior trends, such as how nearly seven hours are spent online daily, I felt fortunate to be able to offer my thoughts from the back yard of an AirBnB in Kalispell, Montana. My attempt to start something new benefited from potentially limitless scale made available to me in large part due to the point in time I was born.

Since this entry, I have spoken with many business owners and educators about the American Dream concept and what it means to them in 2021. The original idea was grounded in a pre-Internet perspective of the world, which had an entirely different time/money equation. Our grandparents didn’t have the luxury of a range of conveniences that are easy to take for granted today, including the ability to generate income or purchase things entirely online without having to even leave one’s chair. There were also arguably fewer distractions and ways to waste time doing things such as scrolling social media feeds and reading angry or troll comments from people you’ll never meet, oftentimes cloaked behind anonymous usernames.

The purpose of this post is not to detail the American Dream (which I personally believe is not dead and, in many ways, more achievable than ever before), but rather to offer a perspective on how making choices with a different consideration set than traditional tenets can change one’s life for the better.

The American Dream commonly includes traditional “life path elements”, such as:

- Go to school, prioritize grades over real world experience

- Earn a college degree, even if it buries you in student debt

- Shortly after graduation, get an entry-level job, pay back student loans for the next 10-20 years

- Work 40-60 hours per week, climbing some form of career ladder

- Buy stuff in the evenings or weekends to counterbalance work and financial stress

- Purchase even more stuff in the attempt to impress people you may never meet nor like

- Borrow as much as the bank will loan you for a house with nice curb appeal that contains rooms that are rarely used

- Save money (sort of)

- Stay out of consumer debt (or at least try to)

- Try to retire by age 65

- Enjoy your final years

All of this assumes you’re able to stay employed throughout the duration, invest for the long-run (retirement funds, post-tax accounts, etc.) maintain good health and don’t get financially crushed by a healthcare-induced bankruptcy. Here’s a quote I saved roughly ten years ago that really resonated with me as I was paying back student loans as quickly as I could:

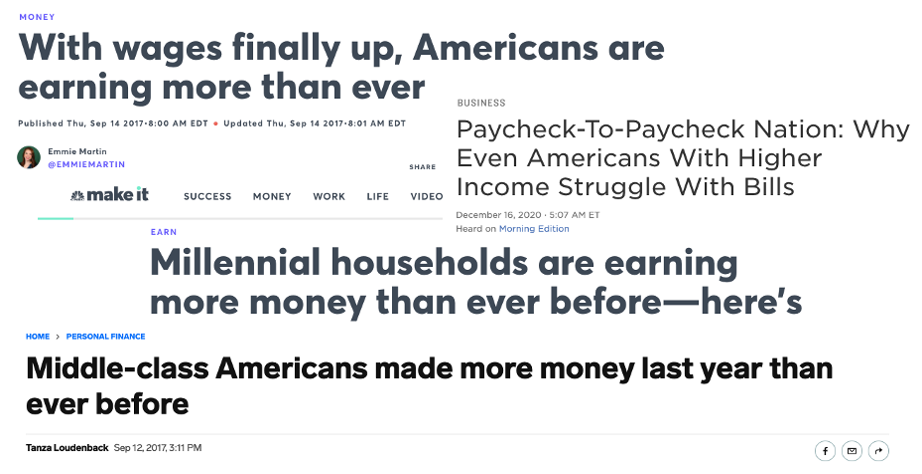

The problem is, as time has proven and the Internet has helped expose, these steps oftentimes don’t work in execution as well as they do in theory: roughly 70% of Americans live paycheck-to-paycheck despite the fact we still live in one of the richest countries the world has ever seen.

To make matters worse, people are earning more money than all prior generations, and yet it’s common for an average family to struggle financially or rely on social in-security for some or all of their retirement income (sources for further detail listed at the bottom of the post).

The fortunate news is, you are the solution, and given the abundance of opportunity the Internet has created many of the positive aspects of the American Dream can still be very much realized if some of the weaker aspects are put into perspective and you’re able to master your own psychology.

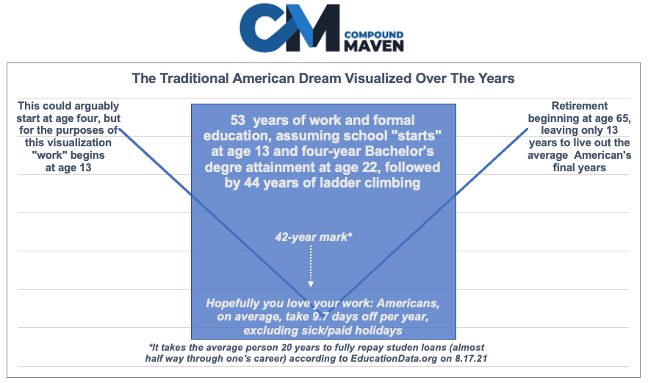

Let’s consider this through the following visual:

26 years of “freedom”, if you include ages 0-13 and 65-78 as non-working years. For the typical American, this equates to only 33% of one’s life. Damn.

Fortunately, we live in a new world in which the Internet offers a way to flip the time/money equation. It has never been easier to make money from the comfort of your own home and most people have what they need in order to do it: a phone, Internet or data connection and grit. Instead, many individuals choose to use these tools for entertainment or social media.

I submit to you a revised way to think through this:

- Master your own psychology to become a producer, not just a consumer

- Consider a framework for abundance thinking

- Reduce your expenses – spend money only on the things you care about for your own happiness and increase the “margin” in your life

- Define what “rich” and the concept of “wealth” means to you

- Max your savings as much as possible, consider more than one income source and additional, symbiotic streams where possible

- Create a game plan for Internet and/or location-agnostic income

- Invest in yourself, not just your employer

- Live on less than you make

- Invest as much as you can

- Get clear about the things you truly value in your life

- Value and learn the best prioritization for you: time often means more than money

- “We don’t buy things with money. We buy things with hours of our lives.” – John Marty

With these concepts in mind, a perspective on the “new American Dream” from an investor educator named Jennifer Welsh may be beneficial:

“The fake American Dream:

- Six-figure salary

- Big house

- Nice car

- Work til you’re 65

Show your friends. Work hard > buy things > keep working? Hamster wheel

Here’s the new American Dream:

- Reduced expenses

- Increased savings

- Time as currency

- Freedom

Fastest way to get there?

Investing > material things

Out with the old and in with the new. Freedom’s in style now.

Goodbye, things.”

In this paradigm “rich” can mean much more than finances. What does rich mean to you? Here are a few alternative forms that be helpful to weigh:

- You can go to bed and wake up as you please

- You can buy any book you’d like

- You have time to read said book

- You have time to exercise and the ability to choose when

- You don’t have to deal with messy public bathrooms

- A short (or zero) commute

- No dress code seven days per week

- Liberal use of the thermostat

“If time is money, attention is our most precious currency.” – Ben Bradbury

For additional insights:

YouTube Clips:

YOU Control YOU! “Intentionality moves the needle”